Destroy, Inflate & Consolidate

Looking back with the aim to speculate the way forward, we have a recap of last week happenings…

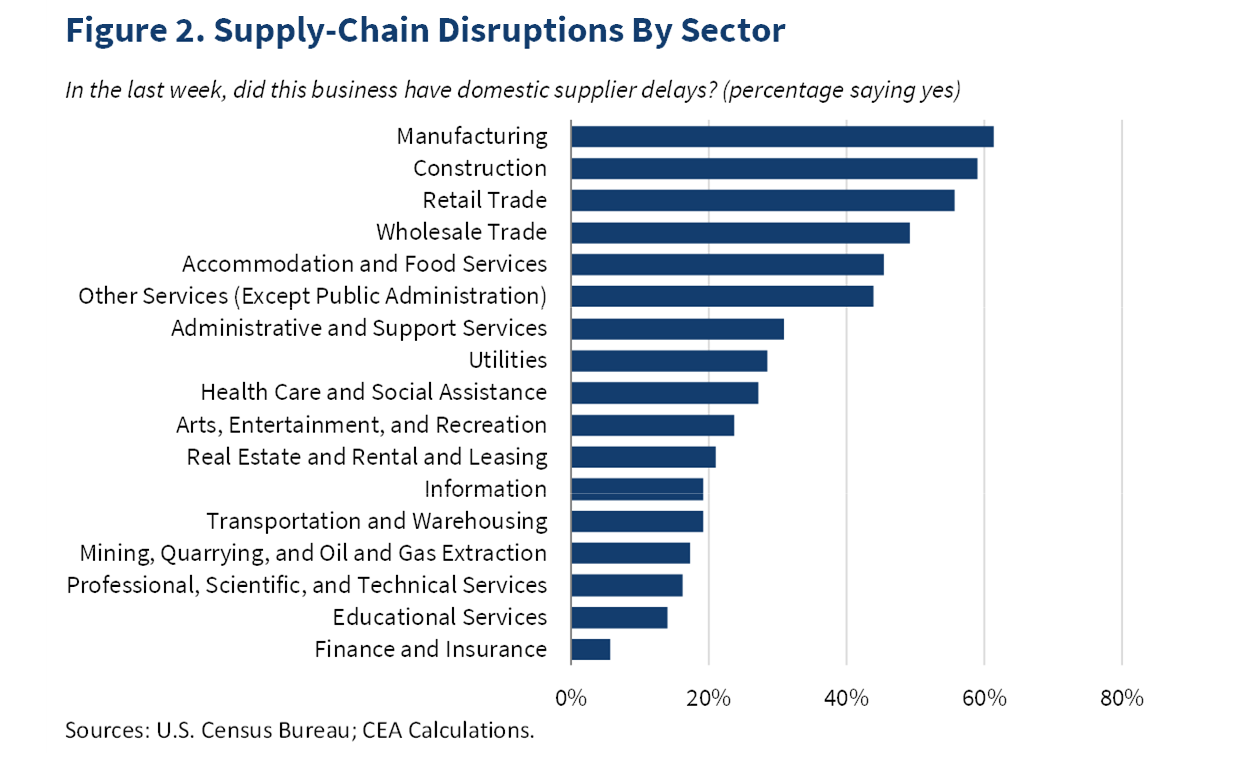

We had the Fed’s Bostic finally admit that Inflation is not transitory, as many have been shouting at the top of their lungs. Quoting him, “It is becoming increasingly clear that the feature of this episode that has animated price pressures --mainly the intense and widespread supply-chain disruptions-- will not be brief. By this definition, then, the forces are not transitory.” We saw US inflation numbers out last week at 0.4% m/m, 5.4% y/y; 0.2% m/m core, 4.0% y/y.

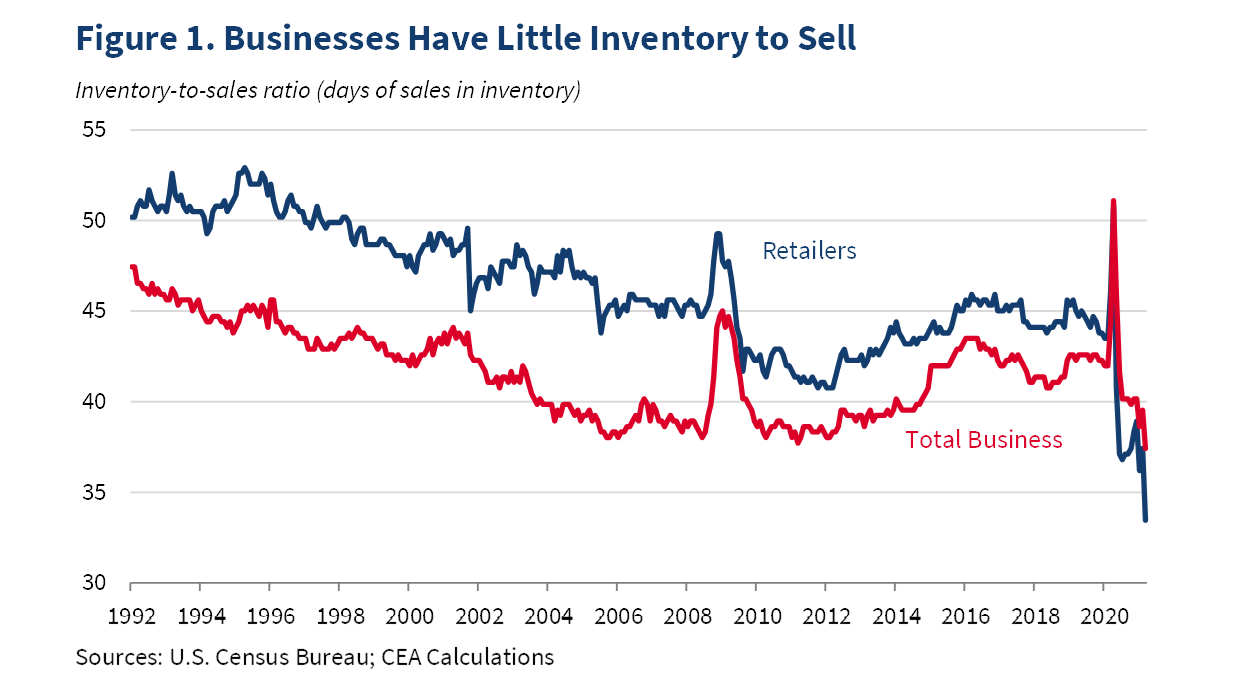

Spikes in energy prices in Europe, Oil moving higher above $80 per barrel for the foreseeable future and lets not try to muddle the waters so as not to impact the flow of goods to shops and markets (Fig 1) via the supply chain disruptions we are all witnessing.

Meanwhile, as the IMF’s Chief executive is hoping everyone forgets about her recent controversy vis-a-vis China her organization is trying to play fast and loose by downgrading its global growth forecast, and warning of inflation and supply-chain disruptions.

No shit, sherlock! Welcome to the party IMF!

We all have observed this developments six months ago! Throwing fuel to the disruptive fire, the Fund is now only downgrading its world GDP for 2021 from 6.0% to 5.9% despite energy and food prices leaping in the last few months despite the Evergrande debacle, hitting 30% of China’s GDP (as Chinese car sales were -17.3% y/y in September, and Chinese coal prices hit another record high, promising even higher electricity prices). Of course, they did not forget to babble the current mantra of Build, Back, Better while ignoring the position they themselves take of Destroy, Inflate, Consolidate.

Add all these to the long list of anecdotes pointing to what The Atlantic is calling the Great resignation, where so many workers are not willing to go back into their low-paid, under-appreciated, stressful jobs.

Meanwhile, as supply-chain decoupling is already happening mainly via labor shortages, Microsoft has announced a split between LinkedIn and what will be “NotLinked” just for China, so further decoupling and deglobalization is taking a beautiful shape. As Nina Xiang, author of ‘US-China Tech War’, notes: “LinkedIn is about the last remaining big American tech firm operating in China that involves content. With it gone, the decoupling between China and the rest of the world will only deepen.”

I do not think anyone in their sane minds will assess our current state of affairs and conclude that things are improving or we are “building back better”, on the contrary, I would suggest governments in concert with technocratic institutions are destroying livelihoods, inflating economies and, consolidating for the conglomerates and big banks.

More reading;

https://www.bloomberg.com/opinion/articles/2021-10-11/supply-chain-disruptions-almost-too-many-reasons-to-count

https://www.whitehouse.gov/cea/blog/2021/06/17/why-the-pandemic-has-disrupted-supply-chains/

(Not related but interesting topic to be addressed in a future entry); https://theintercept.com/2021/10/12/facebook-secret-blacklist-dangerous/

See you tomorrow!

- Ope