Good Afternoon.

As we like to follow the money on Wednesdays entry, we are looking at the flight of capital to jurisdictions with strong private property rights like the US, Canada and the exodus to jurisdictions with low tax policies like Portugal, Dubai, Malta, Seychelles, etc. There is a lot under the surface here, and I will try to uncover some.

As countries are tending towards nationalism and a more centrist approach of governance, they will begin to loose plenty of talent and minds as there is less investment in the people from their respective governments. Protectionism being the new trend and reported to be rising according to a detailed report by risk consultants, Verisk Maplecroft. Their report indicated that over the course of 2020, 34 countries had seen a “significant increase” in resource nationalism, with the pandemic exacerbating an existing trend toward government intervention. Heightening the risk for any investment and scaring off potential investors.

The top 10 in Verisk Maplecroft’s Resource Nationalism Index comprised Venezuela, the Democratic Republic of Congo, Russia, Zambia, Zimbabwe, Kazakhstan, North Korea, Tanzania, Bolivia and Papua New Guinea.

As this trend continues together with capital controls, we will witness the rise of corruption and malfeasance cos we all know how inefficient government is. An example would be in the case of Venezuela and how the nationalization of everything turned the country into a basket case.

Many countries are quickly turning to a quick fix in order to patch the damage instead to trying to fix it. So we will continue to hear of currencies crash like that of the Turkish Lira that is likely to herald a new journey into the monetary abyss and more suffering. Expect this with a currency you use soon.

As nations continue to print money into oblivion thus exacerbating the debt levels, we will watch our money becoming literally worthless (especially those who save money in banks), this has started the rush to buy commodities and hard assets in order to keep the smart money’s purchasing power above inflation as we see double digit inflation numbers in many countries around the world.

The purchasing power of the dollar is declining;

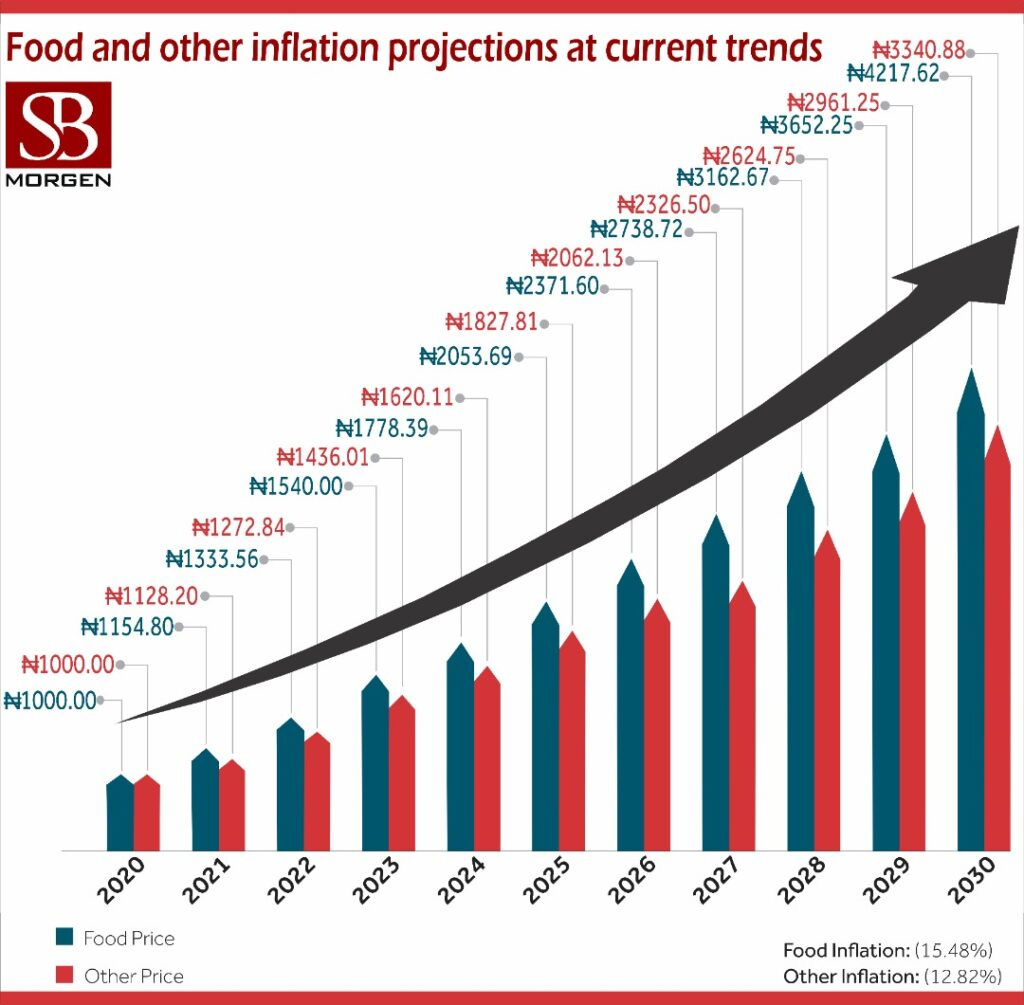

Inflation in food prices in Nigeria and other places are projected to skyrocket;

As commodities continue to surge due to global inflation as indicated above, the tightening of supply and logistical bottlenecks is leading to booming demand for many essential Commodities as world economies recover lockdowns and restrictions.

Remember that Scarcity + Demand = Higher prices!

So far this year, a long-list of Commodities have already hit an all time high record including Aluminum, Copper, Cotton, Coffee, Crude Oil, Natural Gas, Nickel, Lithium, Wheat and Uranium just to name a few.

Macro events that we will not be missing out on includes; U.S CPI Inflation Data, Producer Price Index and Consumer Sentiment analysis to gauge the markets and economy while positioning ourselves to maximize opportunity, reduce our reliance on governments and towards becoming fully decentralized.

In as much as we are working towards building a decentralized future with an aim to relocate to a more favorable jurisdiction, we would be betting on ourselves, innovative projects, likeminded people and most importantly, in hard assets like Physical Gold and Silver, Platinum and Uranium just to name a few. In addition, digital assets like BTC, ETH and other various cryptocurrency tokens.

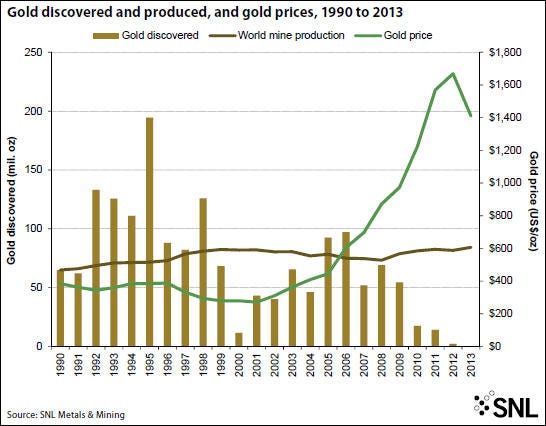

Lets take a look at Gold, as the rate of gold discoveries has been in decline, we have seen a rise in demand for the shiny metal. The price will only look much golden in due time! (sorry for the lame pun, lol).

I am personally positioning my portfolio to look like this and I suggest you get protected with hard assets.

See you on the other side!

- Ope