There is no "decentralization" allowed by the crypto cartel

Slowly the gloves have been coming off regarding my view of the cryptocurrency community/industry and its numerous shiny, attractive “moon boy” decentralized image. As I continue to spend more and more time understanding, learning and growing in this space, the more the veil comes off and I see things clearly as to who is fake and legit, how to spot outright scams, who has the public’s interests at heart and which company/cartel/group is behind the façade trying to control things.

Last week, I wrote on the role of so called “influencers” and their bad faith, highlighting their overly materialistic style of self promotion in the article referenced below (its necessary to point out here that this can become a self reinforcing loop whereby the more flashy/materialistic one comes across online, the more views/attention one receives - emblematic of the lazy/robotic/shallow mental state of the crowd);

But in this article, I will be focusing on a much bigger player/s in the industry and how they control different facets of it.

Of course, it is sad to report that not all that glitters is digital gold in the Cryptoverse (sorry for the pun).

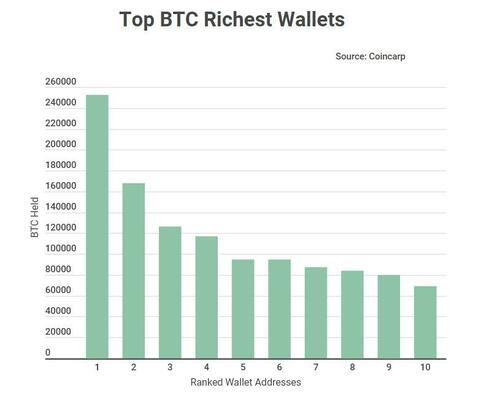

First, I begin with data compiled by Banklesstimes.com, reporting that the top two wallets hold 1.2% and 0.80%. These two wallets, which hold 252,597, and 168,010 Bitcoins are held in Binance and Bitfinex exchanges, respectively.

The comprehensive data also includes more details on all the Bitcoin holders. There are currently over 41 million holders. An analysis of the top 100 holders show that they account for 14.11%, with the amount of Bitcoins held ranging from 252,597 to 9,000 BTC coins.

Lets get some facts straight;

Out of the total 21 million BTC coin supply, 90% is already minted.

2 wallets hold 2% of all BTC.

100 wallets hold 14.11% of all BTC.

41 million current BTC holders.

This shows us only a very small percent of people are at the top of this pyramid, hmm, kind of similar to the same traditional financial system crypto is meant to be an exit from. What happened to the decentralized narrative by the way? Bad news for the idealists, as only a few sits at the top.

Especially in a world where much of the money and power belongs to a select few. For example, the top 1% of the world (in terms of finances) owns over half of the world’s entire wealth. This is a jarring statistic that only exacerbates wealth inequality as there are still billions of human beings without access to banks.

As I have also written before, the U.S. media and thus, global media has consolidated over the decades, erasing the option of choice from a mere 6 companies.

Is this the case in Cryptoverse? Lets dig further..

The truth is that wealth inequality will affect the crypto currency sector, which is championed as leading human beings into a future where central banks and governments do not have control over your finances. But the notion of a universal accepted payment system (whether BTC or ETH) in of itself is a central point whereby the community at large has to agree to use, the question is who gets to distribute/allocate, mine, build its infrastructure and regulate inevitably brings in a central node of operation. And also a critical point of failure.

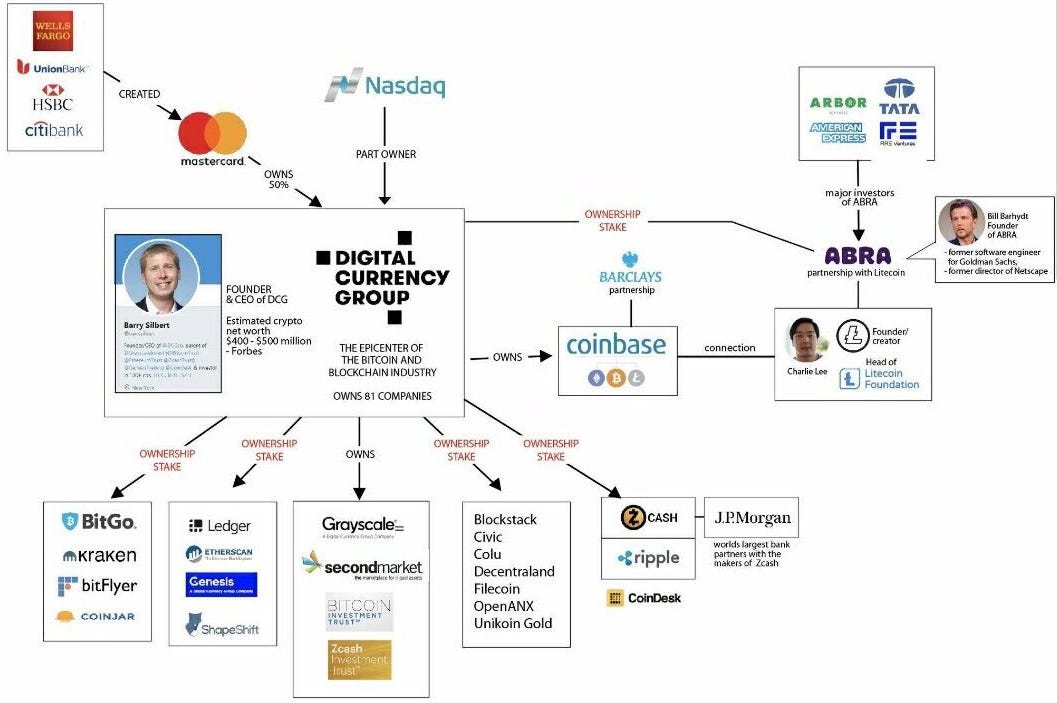

I hereby introduce you to the Digital Currency Group, the new establishment in the crypto industry. Like a gated community. With their own press (Coindesk.com), and their own executive structure.

You wanted “emancipation from the banks”, right? Why fight the establishment when you can become it. Take a look at the connections and influence below;

Expanding on this position, Bitboy has published a series of videos about the crypto cartel, do make sure to watch part 2;

Like I said earlier..

See you tomorrow!

- Ope